|

|

| Rating: 4 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Early Warning Services, LLC |

Zelle App: Simplified Money Transfers Made Easy

Zelle is a convenient money transfer service that partners with various banks and credit unions in the U.S. to provide a fast, secure, and straightforward way to send money to friends and family. The funds are transferred directly from one bank account to another, ensuring quick transactions. If your financial institution offers Zelle, you can access it through your mobile banking app or online banking. For those whose banks do not support Zelle, the Zelle app facilitates sending money to enrolled users who have access through their own financial institutions.With Zelle, users can easily settle payments with trusted individuals using just their email address or U.S. mobile number. The service is free to use, with no additional fees from Zelle, although mobile carrier or bank fees may apply. To get started with Zelle, users can download the app and enroll by linking a Visa or Mastercard debit card to a U.S. checking account, or by using their online banking credentials if supported by their bank. Sending money is a straightforward process of entering the recipient’s contact information, confirming the amount, and initiating the transfer.Zelle simplifies the payment process by allowing users to send money to recipients who are already enrolled in the service, with transactions typically completing within minutes. For recipients not yet enrolled, they will receive a notification and can easily follow the steps to receive the payment. Some banks even offer the option for customers to enroll in Zelle directly through their online or mobile banking platforms, further streamlining the process for users with supported institutions.

Features & Benefits

- Instant Money Transfers: Zelle provides users with instant fund transfers, allowing recipients to receive money directly into their bank accounts within minutes. This eliminates the need for traditional payment methods that may take days to process.

- Broad Bank Integration: Zelle collaborates with major banks in the United States, making it easily accessible to a wide range of users. The app is often integrated into banking apps, simplifying the process of sending and receiving money for account holders.

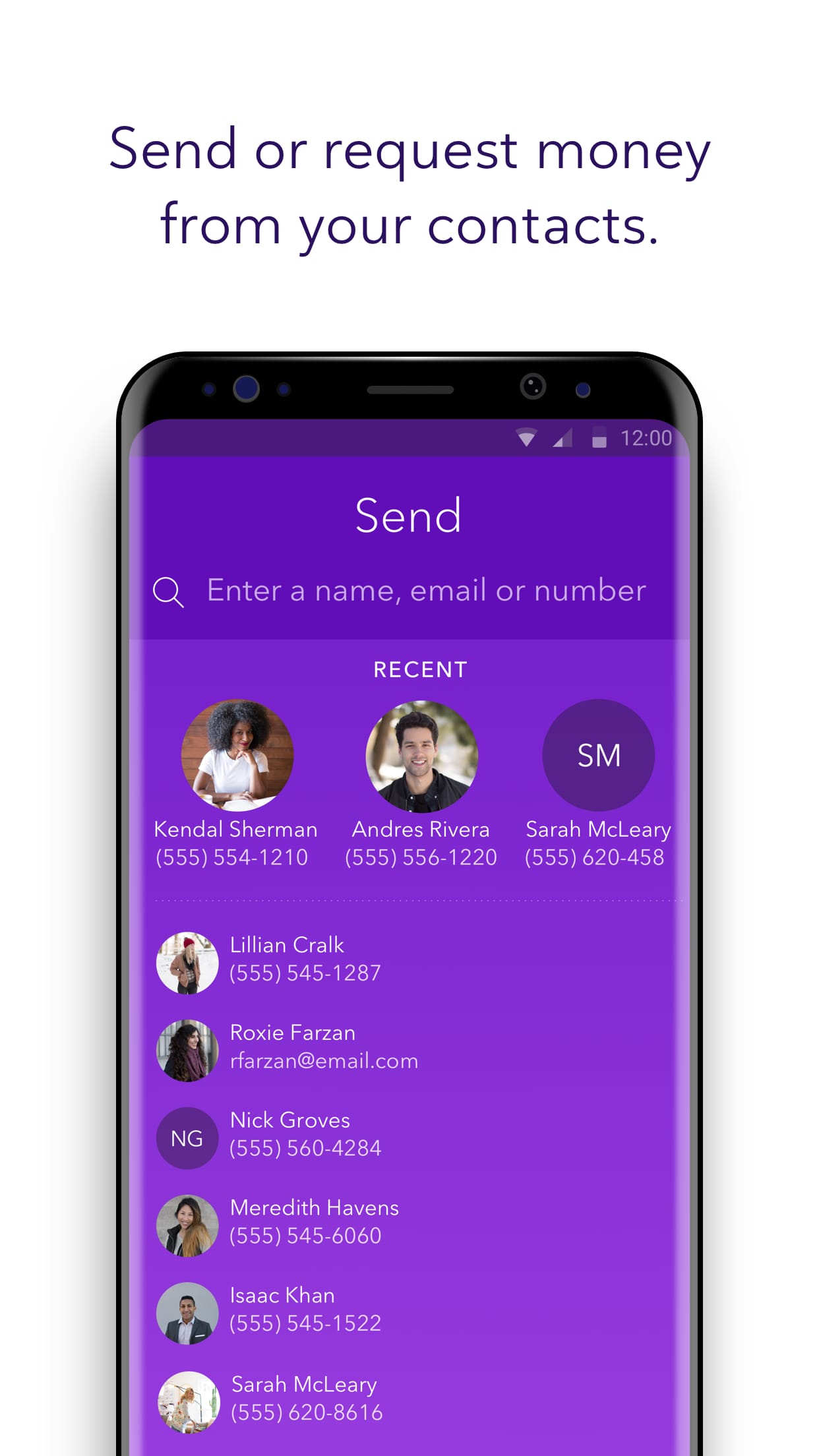

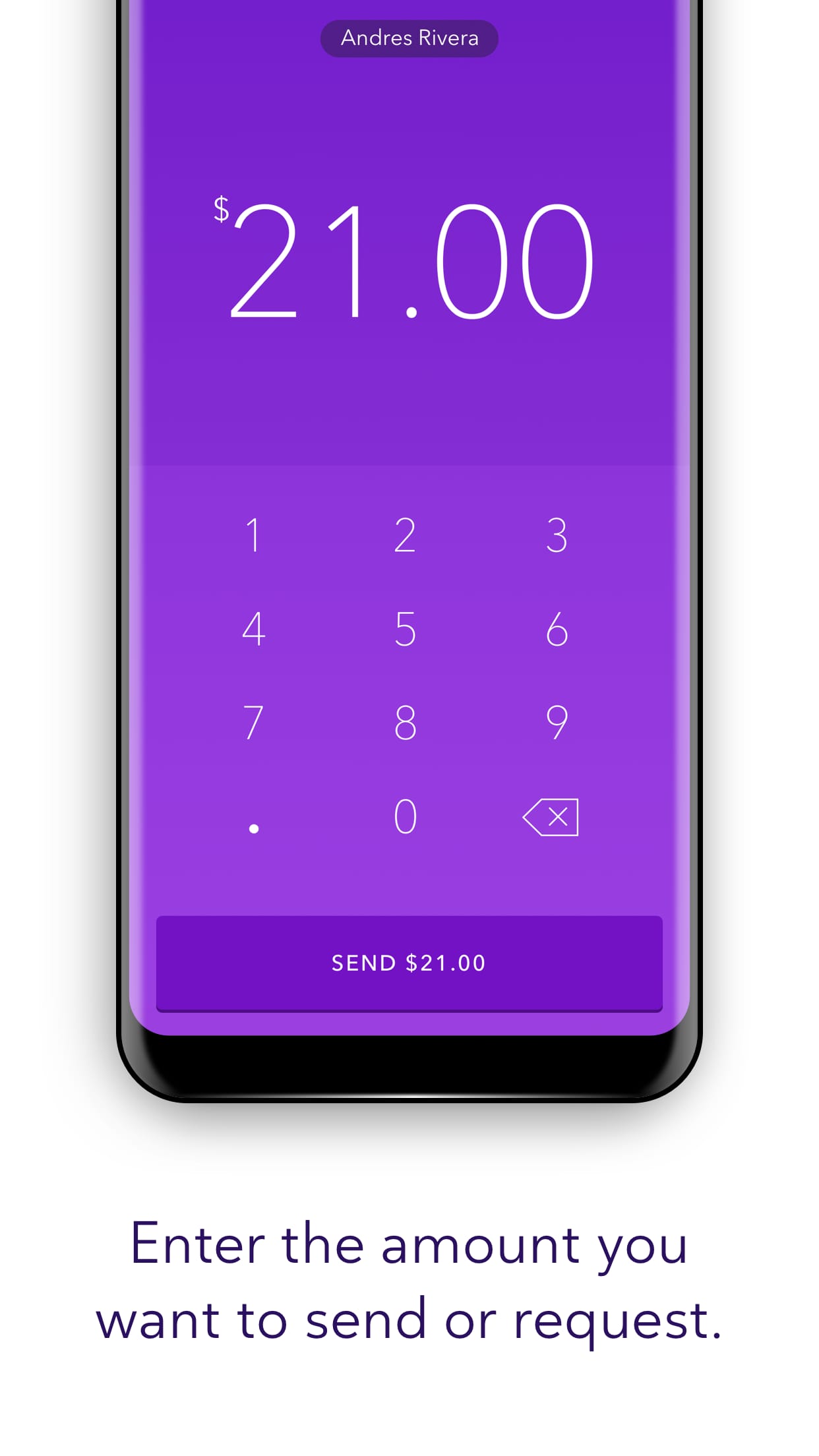

- Simple User Interface: Zelle offers a user-friendly interface that makes sending money a breeze. Users can select recipients from their contacts, enter the desired amount, and complete the transaction within seconds. The straightforward design ensures a smooth and efficient user experience.

- No Additional Fees: Zelle does not charge users any additional fees for sending or receiving money. This makes it an attractive option for individuals looking to avoid transaction fees commonly associated with other payment platforms.

- Secure and Encrypted: Zelle prioritizes the security and privacy of its users. The app employs encryption and authentication measures to protect sensitive information. Users can feel confident that their financial transactions are conducted in a secure environment.

Pros

- Instant money transfers directly into recipients’ bank accounts

- Wide integration with major banks, providing easy access for users

- Simple and intuitive user interface for quick and hassle-free transactions

- No additional fees for sending or receiving money

- Strong security measures to protect user information and transactions

Cons

- Limited to users within the United States, excluding international transfers

- Availability depends on the user’s bank’s participation in the Zelle network

- Lack of customer support options directly within the app

- Some users may experience delays if their bank does not offer real-time processing

- Dependency on internet connectivity for app functionality

Reviews

- Jennifer: “I love using Zelle to send money to my family. It’s so convenient and fast. I can transfer money instantly, and my relatives receive it in their bank accounts within minutes. It saves me a lot of time and hassle.”

- Mark: “Zelle has become my go-to app for splitting bills with friends. It’s incredibly easy to use, and I can send money directly from my bank account. No more dealing with cash or checks. Highly recommended!”

- Laura: “I’ve been using Zelle for a while now, and it has made sending money to my kids at college a breeze. With just a few taps, I can transfer funds to their bank accounts, ensuring they have the money they need quickly.”

- David: “Zelle’s integration with my banking app is fantastic. I don’t need to download a separate app or remember additional login credentials. It’s seamlessly integrated, making it effortless to send money to friends and family.”

- Sarah: “The instant transfers through Zelle are a game-changer. I can send money to pay my share of rent or split a dinner bill, and the recipient gets it almost immediately. It’s so convenient, especially for urgent payments.”

Similar Apps

Venmo: Venmo, developed by PayPal, offers a similar platform for quick and easy money transfers. It incorporates social elements and expense-splitting features, making it popular among friends and family.

PayPal: PayPal, a widely recognized digital payment platform, allows users to send and receive money securely. It offers international transfers, integration with various online platforms, and a range of additional features.

Cash App: Cash App, developed by Square, facilitates peer-to-peer payments and provides additional features like a Cash Card fordebit card transactions and Bitcoin trading.

Google Pay: Google Pay enables users to send money, make online purchases, and even pay in physical stores using their smartphones. It offers loyalty rewards and integrates with Google’s ecosystem of services.

Screenshots

|

|

|

|

Conclusion

Zelle is an app that offers fast and convenient money transfers between bank accounts. With a wide bank network, users can easily connect their accounts and send money to friends and family with ease. Real-time transactions ensure that funds are transferred instantly, making it ideal for urgent payments. Zelle prioritizes security, employing advanced encryption technology to safeguard users’ financial information. The app also simplifies bill splitting, allowing users to divide expenses and request payments seamlessly. However, Zelle’s limited international availability and dependence on bank partners may present some limitations. Additionally, the app lacks standalone account functionality and does not provide payment protection for transactions. User reviews highlight Zelle’s convenience, quick transfers, and security measures. The wide bank network and real-time transactions are praised, while some users express a desire for international availability. Overall, Zelle proves to be a reliable and efficient app for fast and secure money transfers within the United States.