|

|

| Rating: 4.2 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: PayPal, Inc. |

Venmo App: Seamlessly Transfer Funds and Split Expenses

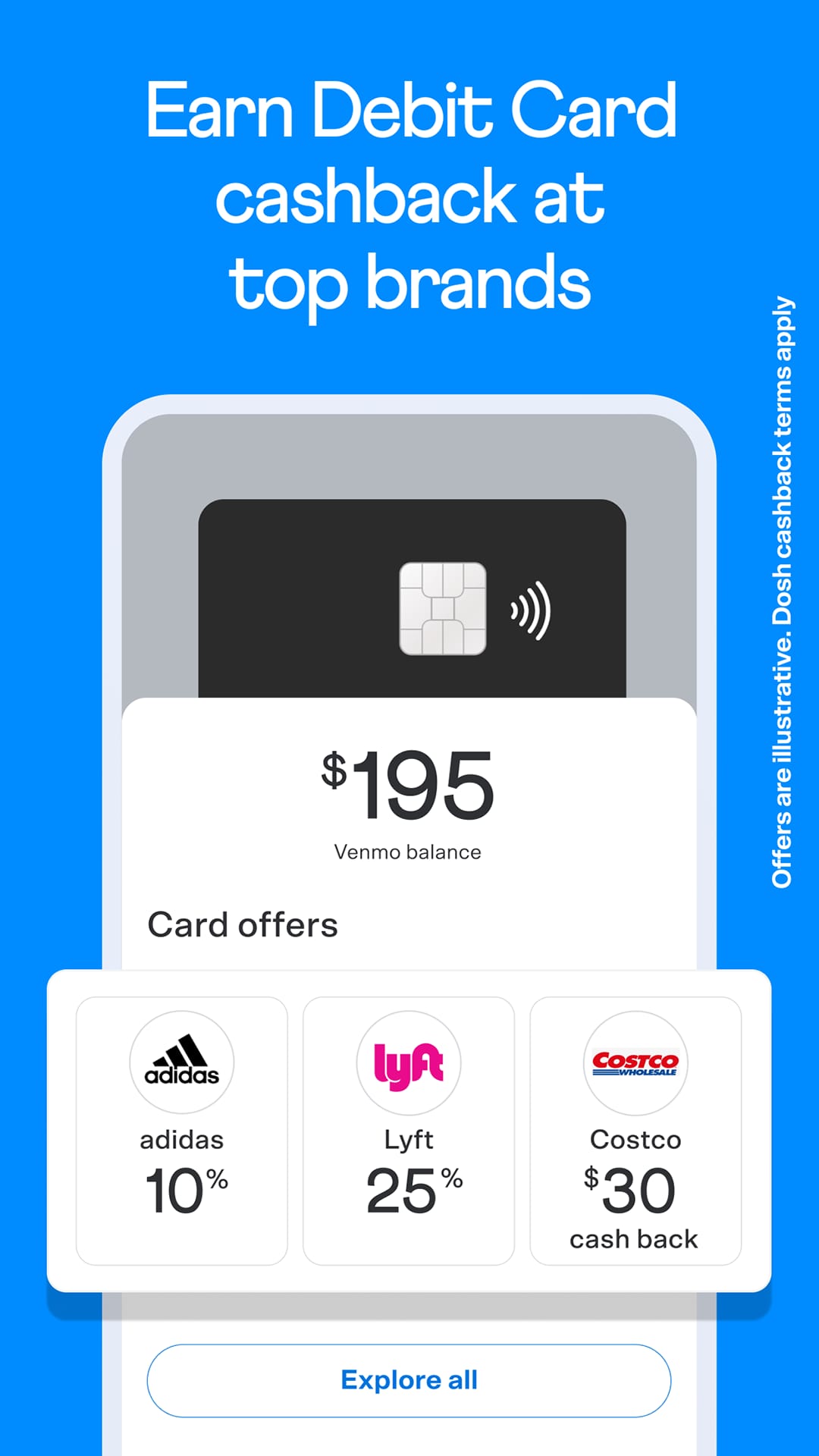

Venmo is a popular app that allows users to send and receive money quickly and securely. With over 83 million users, Venmo offers a convenient way to pay for a variety of expenses, from rent to gifts. Users can also add notes to their payments, allowing them to share and connect with friends. Additionally, Venmo now allows users to split a payment request among multiple friends, customizing the amount each person owes.In addition to its payment features, Venmo offers other financial services. Users can apply for a Venmo debit card, which offers automatic cashback when used at select merchants. There is no monthly fee or minimum balance required. Venmo also offers a credit card that provides cashback rewards on eligible purchases. Users can earn 3% cash back on their top spend category, 2% on the next, and 1% on the rest.Venmo also allows users to buy, hold, and sell cryptocurrency directly within the app. Users can start with as little as $1 and access in-app resources to learn more about cryptocurrency. However, it’s important to note that cryptocurrency is volatile and can fluctuate in value quickly, so users should proceed at their own comfort level.Furthermore, Venmo offers features for businesses. Users can create a business profile for their side gig or small business, all under the same Venmo account. Venmo also provides a touch-free payment option in stores through a QR code, allowing users to scan, pay, and go. Additionally, Venmo can be used for online purchases and in various apps, such as Uber Eats, StockX, Grubhub, and Zola.Overall, Venmo provides a range of convenient and secure financial services, including money transfers, cashback rewards, cryptocurrency trading, and business profiles. Users can manage their money easily with features like instant transfers and direct deposit. However, it’s important to review the terms and conditions for each service and consider seeking advice from financial or tax advisors when dealing with cryptocurrency.

Features & Benefits

- Easy Fund Transfers: Venmo enables users to transfer funds quickly and easily to others. Whether it’s sending money to a friend, paying back a loan, or receiving payments, Venmo simplifies the process with just a few taps. Users can link their bank accounts, debit cards, or credit cards to Venmo for seamless fund transfers.

- Splitting Expenses: Venmo makes it effortless to split expenses among friends or groups. Users can create a payment request and divide the cost of meals, utilities, or shared expenses. Venmo keeps track of who paid what and sends reminders to participants, ensuring smooth coordination and settling of bills.

- Social Interactions: Venmo incorporates social elements that add a fun and interactive touch to financial transactions. Users can like and comment on payments, adding emojis and personalized messages. This feature creates a social network-like environment, making payments more engaging and enjoyable.

- Venmo Card: Venmo offers a physical Venmo debit card that allows users to make purchases using their Venmo balance. The card can be used wherever Mastercard is accepted, providing users with a convenient and secure payment option, both online and in physical stores.

- Security and Privacy: Venmo prioritizes the security and privacy of its users. The app utilizes encryption and multi-factor authentication to protect financial information. Users also have control over their privacy settings, including the ability to choose who can see their payment activity.

Pros

- Easy and convenient fund transfers among friends and family

- Simplified process for splitting expenses and settling bills

- Social interactions and engagement through likes and comments

- Venmo debit card for convenient purchases with Venmo balance

- Strong security measures and user privacy controls

Cons

- Limited international functionality, primarily focused on the United States

- Transaction fees for certain types of payments, such as credit card transactions

- Public nature of payment activity, which may be a concern for those seeking more privacy

- Limited customer support options, primarily relying on self-service resources

- Dependency on internet connectivity for app functionality

Reviews

- Sarah: “Venmo has made splitting expenses with my roommates a breeze. We can easily split the rent, utilities, and even grocery bills. The social aspect adds a fun element, and I love seeing my friends’ comments and reactions on our transactions.”

- John: “Sending money to friends has never been easier since I started using Venmo. I can quickly transfer funds for concert tickets, dinners, and other shared expenses. It saves me the hassle of dealing with cash or writing checks.”

- Emily: “I love using Venmo to pay back friends for small loans. It’s so convenient, and I don’t have to worry about carrying cash or finding an ATM. Plus, the ability to add personalized messages and emojis adds a fun touch to each transaction.”

- Mike: “The Venmo card is a game-changer. I can use my Venmo balance to make purchases anywhere that accepts Mastercard. It’s great to have an additional payment option, especially when I don’t want to use my credit card.”

- Lisa: “Venmo has become an essential app for me. I can easily split bills with friends, pay back colleagues for lunch, and even receive payments for freelance work. The app’s security measures also give me peace of mind.”

Similar Apps

PayPal: PayPal, the parent company of Venmo, offers a similar platform for sending and receiving money. With a wide user base, PayPal allows for seamless transactions, international payments, and integration with various online platforms.

Cash App: Cash App, developed by Square, provides a peerto-peer payment service that allows users to send and receive money quickly. It also offers features like a Cash Card for making purchases and investing in stocks.

Zelle: Zelle is a digital payment network that enables users to send money directly to bank accounts in the United States. It is often integrated into banking apps, making it convenient for users to transfer funds.

Google Pay: Google Pay allows users to send money, make online purchases, and store loyalty cards. It also offers contactless payment options through NFC technology, making it easy to pay with a smartphone.

Screenshots

|

|

|

|

Conclusion

The Venmo app offers a range of features and benefits for convenient peer-to-peer payments. Users can easily send and receive money, split bills, and share expenses with friends, eliminating the need for cash or checks. The app’s social payment experience adds an interactive element, allowing users to view and engage with their friends’ payment activities. Venmo provides multiple payment options, including bank transfers, debit cards, and credit cards, ensuring flexibility for users. The inclusion of the Venmo card enables offline purchases at any Mastercard-accepting merchant, further enhancing convenience. Integration with merchants streamlines online purchases, reducing the need to repeatedly enter payment information. However, privacy concerns and transaction limits should be considered. Fees for certain transactionssuch as instant transfers or credit card payments and limited international availability are also factors to be aware of. Some users have reported difficulties with customer support, highlighting an area for improvement. User reviews emphasize the convenience and social aspect of Venmo, while also mentioning privacy concerns, international availability limitations, and the need for better customer support. Overall, Venmo proves to be a popular choice for easy peer-to-peer payments, offering a unique and engaging payment experience.