|

|

| Rating: 4.6 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: Block, Inc. |

Cash App: Simplifying Money Transactions

Cash App is a popular mobile payment service developed by Square, Inc., launched in October 2013. This financial platform allows individuals to send and receive money instantly through the app, providing a convenient and straightforward way to manage finances digitally. Cash App has significantly grown in popularity, especially among younger users, due to its user-friendly interface and versatile features that extend beyond simple money transfers.One of the standout features of Cash App is its ability to allow users to receive their paycheck directly into their Cash App account through direct deposit, facilitating immediate access to funds without the need for a traditional bank account. Additionally, the app offers a free, customizable debit card, known as the Cash Card, which users can use to spend their Cash App balance at both physical and online retailers, as well as withdraw cash from ATMs.Cash App also supports investing in stocks and Bitcoin, making it an accessible entry point for users interested in the financial markets or cryptocurrency without requiring a separate brokerage account. Users can buy, sell, and hold stocks and Bitcoin directly through the app, starting with as little as $1, democratizing access to investment opportunities that were traditionally more complex or required more substantial capital.The platform incorporates several security features to protect users’ information and transactions, including password protection for payments, encryption, and fraud protection. Users can also enable additional security measures, such as two-factor authentication, to further secure their accounts.Despite its many benefits, Cash App has faced criticism and challenges, particularly regarding customer service issues and fraud. The platform has been targeted by scammers, prompting Cash App to invest in education and resources to help users recognize and avoid fraudulent activities. Users are advised to be cautious when sending money and only transact with people they know to minimize the risk of scams.Cash App’s functionality has expanded to include unique features like the ability to buy and sell Bitcoin, invest in stocks, and access exclusive discounts through “Cash Boosts” when using the Cash Card at selected merchants. These boosts offer instant discounts at coffee shops, restaurants, and other participating businesses, adding value for users and incentivizing the use of the Cash Card.In conclusion, Cash App represents a modern financial tool that caters to the needs of a digital-savvy generation, offering a blend of convenience, accessibility, and innovative features. Its continued expansion and adaptation to user needs highlight its role as a significant player in the fintech industry. However, like any financial platform, users should remain vigilant about security and privacy to make the most out of their Cash App experience safely.

Features & Benefits

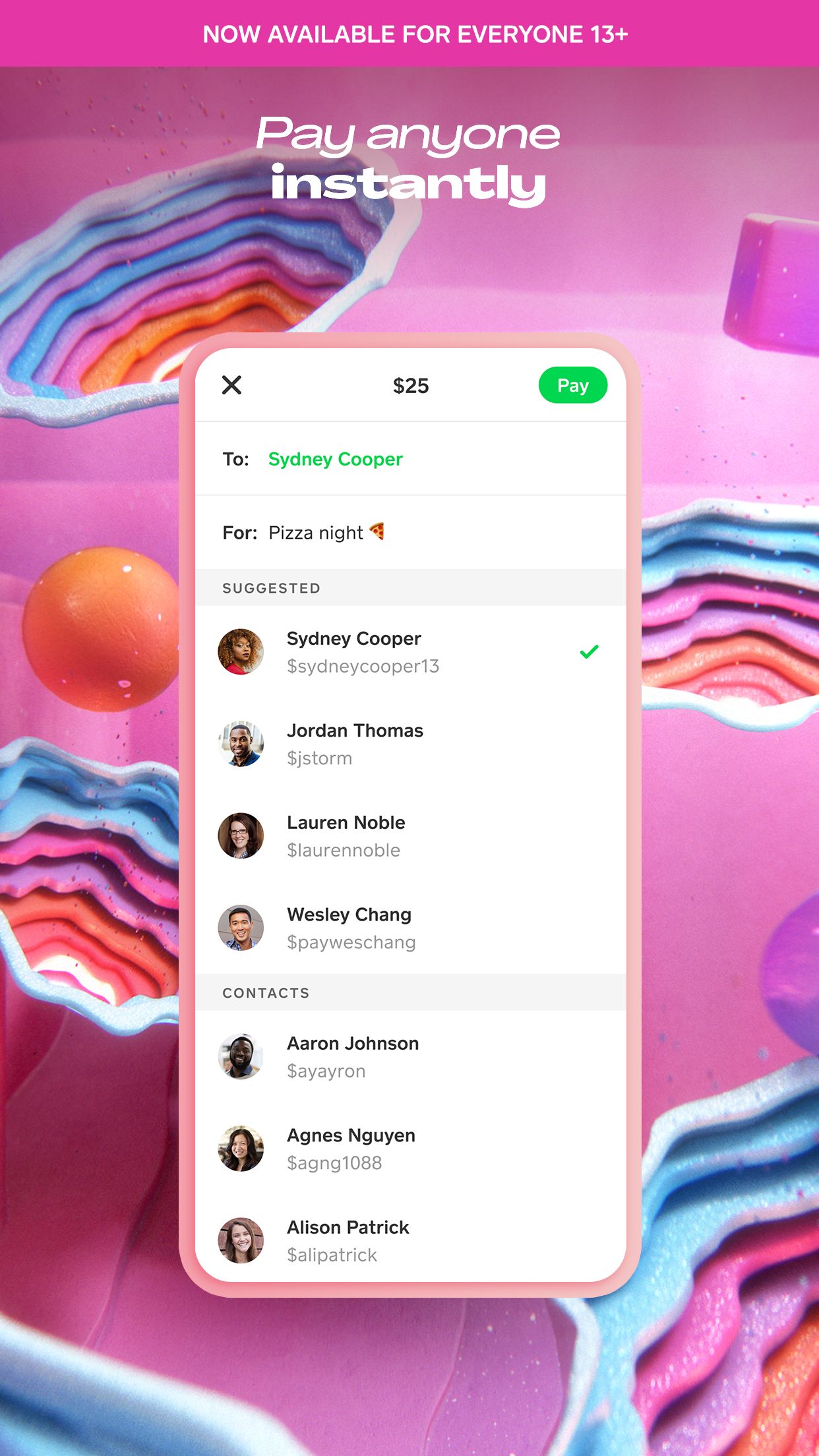

- Peer-to-Peer Payments: Cash App enables users to send and receive money instantly to and from friends and family. Whether splitting a bill, paying rent, or reimbursing someone, Cash App simplifies peer-to-peer transactions without the need for cash or checks.

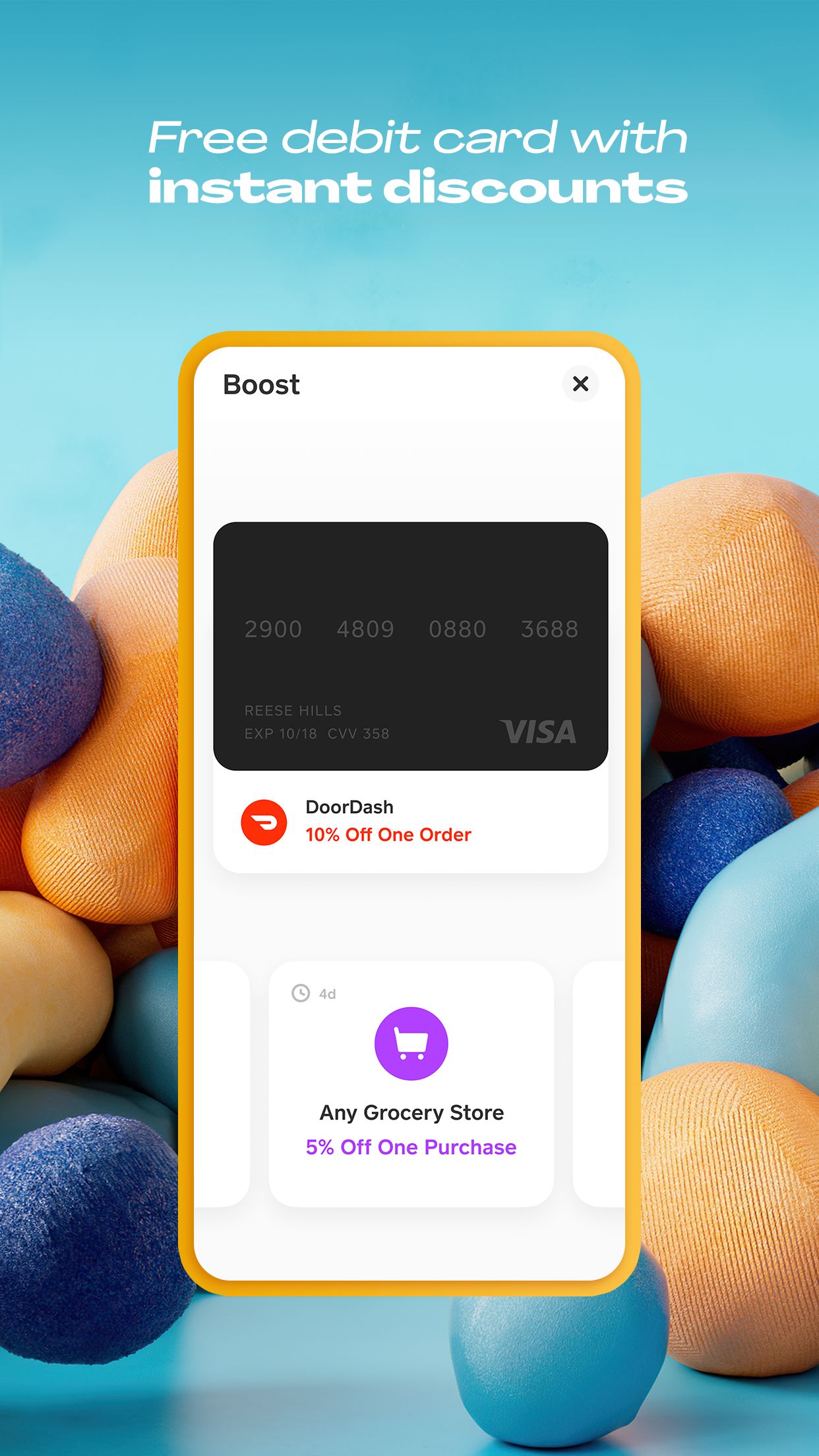

- Cash Card: Cash App offers a physical debit card called Cash Card. It is linked to the user’s Cash App account and allows them to make purchases at physical stores or withdraw cash from ATMs. The Cash Card provides a convenient way to access funds and manage expenses.

- Direct Deposit: Users can set up direct deposit through Cash App, allowing them to receive paychecks, government benefits, and other regular payments directly into their Cash App balance. This feature provides added convenience and eliminates the need for traditional bank accounts.

- Investing Options: Cash App allows users to invest in stocks and Bitcoin directly from the app. With as little as $1, users can purchase fractional shares of popular stocks and participate in the cryptocurrency market, giving them an opportunity to grow their wealth.

- Boosts and Rewards: Cash App offers various Boosts and rewards to its users. Boosts provide instant discounts at select merchants, such as restaurants and coffee shops, while rewards offer cashback on specific purchases. These features help users save money and make their transactions more rewarding.

Pros

- Simple and intuitive interface for easy navigation

- Instant and convenient peer-to-peer payments

- Cash Card for physical purchases and cash withdrawals

- Direct deposit option for receiving payments

- Investment features for stocks and Bitcoin

Cons

- Limited availability outside of the United States

- Some transactions may incur fees, such as instant transfers

- Customer support response time can vary

- Limited functionality compared to traditional banking apps

- Potential security concerns if the user’s device is compromised

Reviews

- John: “I love Cash App! It’s so easy to send money to my friends and split expenses. The Cash Card is a game-changer. I use it everywhere, and I even earn cashback on my purchases.”

- Sarah: “Cash App has made managing my finances a breeze. I receive my paycheck directly into the app and can instantly access and use the funds. It’s convenient and saves me time.”

- Emma: “I’ve been using Cash App for investing, and it’s been great. I can buy stocks and Bitcoin with just a few taps. It’s made investing accessible and fun for me.”

- Michael: “The Boosts are fantastic! I save money every time I use my Cash Card at participating merchants. It’s like getting instant discounts without any hassle.”

- Lisa: “While Cash App is convenient, I wish it had more features like budgeting tools or expense tracking. It’s great for basic money transactions, but I still need other apps for financial planning.”

Similar Apps

Venmo: Venmo is a popular mobile payment app that allows users to send and receive money, split bills, and make payments. It offers social features, such as transaction comments and friends’ activity feeds.

PayPal: PayPal is a widely recognized digital wallet and payment service that enables users to send and receive money securely. It offers a range of features, including online payments and integration with e-commerce platforms.

Zelle: Zelle is a peer-to-peer payment service that allows users to send money directly from their bank accounts. It offers fast and secure transactions, often with instant transfer capabilities.

Google Pay: Google Pay is a mobile payment app that allows users to send money, make online and in-store payments, and manage loyalty cards. It integrates with Google services and offers a seamless user experience.

Screenshots

|

|

|

|

Conclusion

In conclusion, Cash App offers a range of features and benefits that make it a convenient and secure mobile payment solution. With its seamless money transfer capabilities, Cash Card for easy spending, support for Bitcoin transactions, direct deposit functionality, and enhanced security measures, users can enjoy a hassle-free payment experience. While it has some limitations, such as limited availability in certain regions and occasional delays in customer support, the overall value it brings to users’ financial transactions and money management outweighs these drawbacks. Cash App continues to be a popular choice for individuals seeking a reliable and user-friendly mobile payment app.